Balance Sheet Preparation & P&L | Small Business Balance Sheet | Prepare your Financial Report Online

Let the dedicated team of Legal251 handle all your Balance Sheet Preparation & P&L records and statements so that you don’t have to worry about the cash flow and you can focus on your goals.

Book Service Now

@ ₹ 551.00 only /- ( Including GST )

Name *

Contact Number *

Email *

City/district *

Category *

0 Years

Of Experience

0 +

Cases Solved

0 +

Awards Gained

0 k +

Trusted Clients

0 k+

Queries Solved

Maintaining Balance Sheet and Profit & Loss records and statements is vital for a business as it

summarizes the business' trading transactions - income, sales, and expenditure, and the resulting

profit/loss for a given period. Let us help you keep it managed.

A Balance Sheet gives a quick review of your business's total assets and total liabilities along

with tracking owner and shareholder investments (equity). Your Balance Sheet compliments your P&L

(Profit & Loss) and Cash Flow statements that tell the whole story of your investment. The Profit &

Loss statements or income statements show your sales and expenses. Similarly, the cash flow

statements relate everything about how and where your money is moving into or out of your business.

One should review their Balance Sheet and P&L statements monthly to check if everything is going in

the same direction as planned or if there is any need for a change in strategy. However, due to so

many responsibilities and a lack of knowledge and resources, most business owners often forget about

it. But don't worry. We will help you with your Balance Sheet Preparation & P&L tasks.

How to

apply

How to

apply

Essentials of preparing Balance Sheet & P&L for Small Business

Essentials of preparing Balance Sheet & P&L for Small Business

Small businesses often operate within constrained financial environments, making it imperative to monitor their financial status diligently. A balance sheet offers a comprehensive overview of a company's financial position, enabling entrepreneurs to assess liquidity, solvency, and overall performance. By leveraging insights derived from balance sheets, small business owners can make informed decisions, attract investors, and steer their companies toward sustainable growth.

In essence, a balance sheet is not merely a financial document but a strategic tool that empowers small business owners to make informed decisions, attract external support, and navigate the complexities of the business landscape with confidence.

A balance sheet serves as a financial compass for small businesses, guiding them through the turbulent waters of entrepreneurship. Its significance lies in several key aspects that directly impact the success and sustainability of small enterprises:

-

Assessment of Financial Health

-

Decision-Making Support

-

Attraction of Investors and Lenders

-

Stakeholder Communication

-

Strategic Planning

-

Compliance and Regulation

Components of a Basic Balance Sheet

Components of a Basic Balance Sheet

A basic balance sheet serves as a cornerstone in financial reporting, offering a structured view of a company's financial standing at a given moment. Here are the essential components:

-

Assets:-

Assets encompass everything a company owns or has a claim to. This includes tangible assets like cash, inventory, and property, as well as intangible assets like patents or goodwill.

-

Liabilities:-

Liabilities represent the company's financial obligations to outside parties. This includes debts, accounts payable, and accrued expenses.

-

Shareholders' Equity:-

Shareholders' equity reflects the company's net worth, calculated by subtracting liabilities from assets. It represents the portion of the company owned by shareholders.

By meticulously detailing these components, a basic balance sheet provides a clear picture of a company's financial health, aiding in decision-making and financial planning.

What is the Balance Sheet Equation between Assets and Liabilities?

What is the Balance Sheet Equation between Assets and Liabilities?

The balance sheet equation, also known as the accounting equation, is a fundamental concept in financial accounting. It states that a company's assets must equal its liabilities plus shareholders' equity. This equation ensures that the resources owned by the company (assets) are financed either by borrowing money (liabilities) or by the owner's investment in the business (equity).

The balance sheet equation forms the basis for understanding a company's financial position. By maintaining a balance between assets and liabilities, businesses can assess their liquidity, solvency, and overall financial health. This equilibrium is essential for investors, lenders, and other stakeholders, as it indicates the company's ability to meet its obligations and generate returns on investment.

Further, the balance sheet equation provides a framework for financial reporting and analysis, allowing businesses to track their financial performance and make informed decisions. Understanding this equation is crucial for interpreting balance sheets and evaluating the financial stability of a company.

Benefits to prepare Balance Sheet Preparation & P&L Online

Benefits to prepare Balance Sheet Preparation & P&L Online

-

Prompt Balance Sheet Report

-

Up to date Financial Statement

-

Updated Accounting Software

-

Determine Risk & Return

-

Increased Productivity

-

Boost Efficiency

-

Streamlined Process

-

Managed Liquidity

-

Controlled Solvency

-

Secures Finances

-

Control Over Expenses

-

Tax Analyzation

-

Tracks Business Performance

-

Complete Information

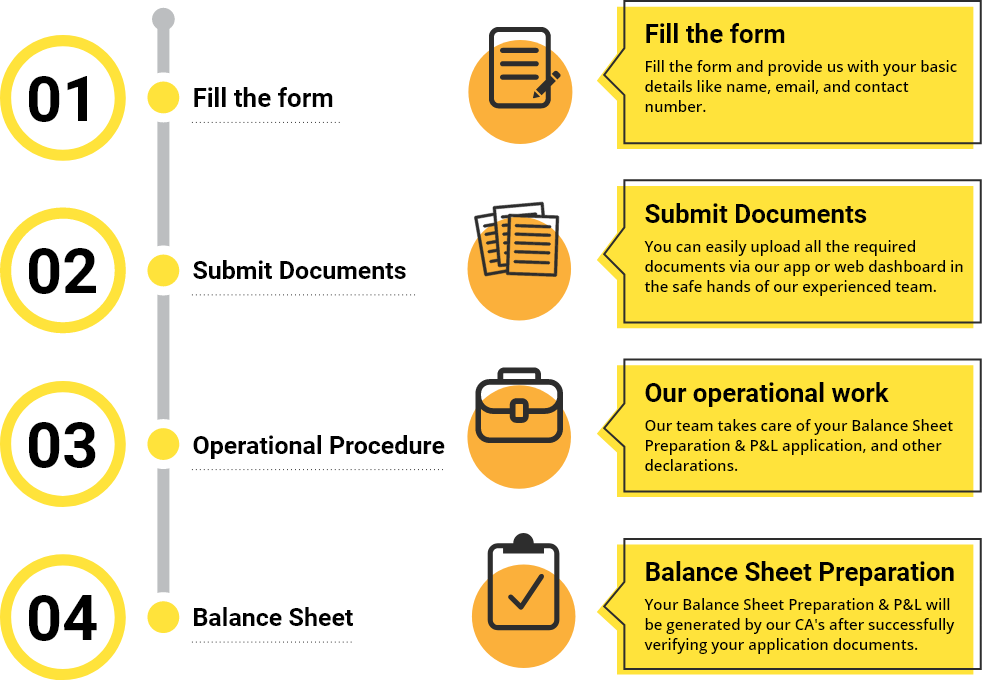

Registration Process to get your Balance Sheet and P&L prepared by Legal251

Registration Process to get your Balance Sheet and P&L prepared by Legal251

Our CAs will review all the documents you submit to lessen the chances of incorrect or misleading information and smooth the process.

Our best CA professionals are here to help you with document requirements and licensing necessities.

The respective professional will move further with your documents to prepare your Balance Sheet Preparation & P&L.

Our CAs will prepare your Balance Sheet & P&L after checking all the related details, assets, and liabilities, according to the reporting date of your company.

It's recommended to wait until one of our experts contacts you to let you know your Balance Sheet Preparation & P&L has been prepared.

FAQs on Balance Sheet Preparation

FAQs on Balance Sheet Preparation

The attributes of a balance sheet are Current Assets, Long Term Assets, Current Liabilities, Long Term Liabilities, Shareholders Equity, Account Balance, and Amortization or Depreciation Expenses.

If you find your Balance Sheet is not truly balanced, there might be some

ambiguity due to these reasons:

Inventory, Cash or Cash Equivalents, Accounts Receivable, Short-term Marketable Securities, and other comes under current assets.

Long-term marketable securities, Property, Goodwill, Intangible assets, and others are non-current assets.

The Salaries of people with administrative roles are included as fixed expenses because they are not directly related to revenue. However, it becomes tricky for people in manufacturing roles, as the labor is associated with making a product which is included in the cost of goods sold section once the product is sold.

The Balance Sheet shows the assets, liabilities, and shareholder equity at a given time. In contrast, a P&L statement summarizes a company's revenues, expenses, and costs during a particular period.

No, there's no difference between these two terms. An Income Statement is the same as a Profit & Loss Statement with two terms and vice versa. A Profit & Loss Statement shows a company's total income, revenue generated, and business cost to find the subsequent profit for a specific period.

The year-to-date or profit & loss statement is a company's financial statement referring to the amount of profit an investment made from the current year's first day.

Before preparing the balance sheet, one must create the P&L account first.

The critical components of a profit & loss statement for small businesses are - Costs of Goods Sold, Revenue, Gross Profit, Expenses, and Net Profit or Loss.

THEY TRUST US

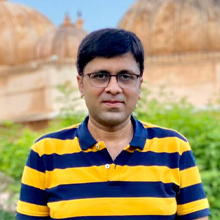

Mr. Rajat Maheshwari

Director Rajat Gems & Jewellery Pvt. Ltd.

Legal251 is

the

best platform for getting consultancy be it in any legal domain they provide

best solution for your query.I am satisfied with their work. What i was

expecting i

got it from Legal251. And I would really appreciate their cooperative work and

how

they deal and cooperate with their customers.

They are the best in business as you may know. There are many complications in

Filing

GST & Income Tax returns for jewellery supply & design business they make all

these

very easy and

efficient.

Mr. Chirag Jain

Director Samrudhi Innovation

For people

like

us who are surrounded by work, legal251 is like a gift. Be it a busy day, or a

deadline, legal251 can always be counted upon. The customer service is always up

to

the mark and the advices and solutions are always promising. Within 48 hrs of

the

query you can have your solution in your hand, and all this, just a few clicks

away

and inside your pocket. Legal work is now on a whole different level.

Mr. Sachin Karma

Co-Founder Today's Bharat

Legal251

changes

the very idea which most people have about getting any legal work done. Making

the

whole process so convenient and also online makes it so easy for everyone to

work

with. If talking about quality work, they have absolutely no match. A platform

as

big as Today's Bharat required a very complete and descriptive terms of

condition

and privacy policy. This was greatly achieved with the help of experts at

Legal251.

Mr. Vipin Soni

Well Known Financial Consultant

I'm thrilled to share my exceptional

experience with

LEGAL251. Their top priority is evident: providing the best and speediest

solutions.

Their professionalism and expertise stood out. The remarkable speed at which

LEGAL251 operates truly sets them apart. Their responses were prompt, and packed

with insightful guidance. Any queries I had were addressed immediately. For

those

seeking legal assistance that's efficient and of the highest quality, I

wholeheartedly endorse LEGAL251.

Growth & Improvement

We believe in growth and improvement at all costs. For us, growth is the law of life and it shall be fulfilled. We know the importance of business and its growth for you.

Support & Availability

We feel how much pain even a small problem or query can cause, that is the reason we are available to support you and solve any of such problems at every particular instance in time.

Experienced Team

All the members of our team are experienced individuals who believe in professionalism and customer satisfaction above all. Each one of them is passionate in their respective fields.

Focus

Any assigned task is of utmost importance to us, that's why our team members are always focused on taking care of even the smallest of our clients' needs and requirements.

Value for Money

We understand that the money being spent is hard-earned, therefore we utilize every single penny that you pay us in the most effective way possible hence providing the best value for money.

Care & Regards

We believe you to be a part of this family and that all your problems, as well as achievements, are our very own. Your interests are ours and their fulfillment is at the top in our regards.

We are here to help you! Chat with us on WhatsApp for any discount queries or more.