Online GST Registration

Register yourself as a trusted business of this country with GST online in minutes. Our experts are ready to guide you for an easy GST Registration.

GST Registrations are one of the topmost priorities for businesses and sailing through this process efficiently is the ultimate aim. List your business for GST effortlessly with experts at Legal251 and start focusing on the growth and productivity part. In the GST Regime, organizations whose turnover surpasses Rs.40 lakhs* (Rs.10 lakhs for North Eastern and slope states) are required to enroll as ordinary available individuals. The GST registration process usually takes between 2-6 working days.

Book Service Now

@ ₹ 2251.00 only /- ( Including GST )

Name *

Contact Number *

Email *

City/district *

0 Years

Of Experience

0 +

Cases Solved

0 +

Awards Gained

0 k +

Trusted Clients

0 k+

Queries Solved

Currently, the types of GST in India are CGST, SGST and IGST. This simple division helps

distinguish between inter-state and intra-state supplies and mitigates indirect taxes. CGST stands

for Central Goods and Services Tax. It is a category of GST that the Central Government collects.

SGST stands for State Goods and Services Tax and IGST stands for Integrated Goods and Services Tax.

CGST, SGST and IGST work according to the place of transactions.

In the case of inter-state

transactions, GST is collected as IGST, which indirectly charges tax for the State and Central

governments clubbed together. SGST and CGST are collected in case of intrastate transactions and are

both collected directly for the State and Central Governments, respectively. Thus, CGST, SGST and

IGST work according to the place of transactions.

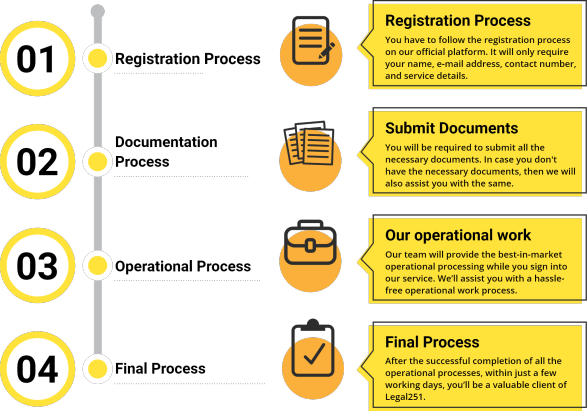

How to Apply for GST Registration

How to Apply for GST Registration

Benefits of Getting GST Registration Done through

Legal251

Benefits of Getting GST Registration Done through

Legal251

Budget-Friendly Service

No Hidden Charges

Helps in Documentation

Reduces cascading effect

Ease of Purchase

Decreased Complex GST Registration

After Service Support

Best Virtual Assistance

Avoiding Common Mistakes in GST Registration

Avoiding Common Mistakes in GST Registration

-

Filling of incorrect personal details

-

Choosing the wrong type of GST Registration

-

Uploading illegible documents

-

Ignoring the threshold limit set by the government

-

More than a single registration for the same business

-

Opting for the wrong GST category

-

Not keeping an eye on the GST Registration Status

Documents Required for GST Registration

Documents Required for GST Registration

Sole Proprietorship / Individual

HUF

Partnership deed / LLP Agreement

Society / Trust / Club

Private limited / Public limited / One person company

Don't have all these documents?

We will

help you in preparing these documents

Just call on

*Other documents might be required additionally by the department

GST Registration: Importance for Business Growth

GST Registration: Importance for Business Growth

The GST Registration process is important for your business to grow. Firstly, the process of GST registration will help you with legal tax compliance as it makes an easier and more flexible taxation system for you. It also enhances your business transparency and ensures your credibility in the market. With the growth of your business, you will be able to expand your business roots across different regions.

Secondly, it will open your doors for business expansion and collaboration. With the proper GST registration, your business can become eligible for participation in the concerned government contracts and tenders. It will help your business make more market contacts and build a unique business identity.

Lastly, the complete and proper GST Registration process can also help your business to streamline supply chain operations. GST registration will also provide you with financial benefits, coupled with the streamlined interstate trade, position businesses for sustainable expansion and success in an ever-evolving business.

GST Registration for Small Businesses

GST Registration for Small Businesses

For small businesses, GST registration provides numerous benefits such as it provides the ability to claim an input tax credit. It will also benefit with easy selling of goods and services across states and provide legal security as operating without a GST registration can lead to heavy penalties.

However, small businesses should take professional advice. With our experienced legal experts, we'll be there to provide you with the right information and guidance related to your GST registration.GST has revolutionized small businesses' work in so many ways by eliminating the burden of taxation policies it helped small businesses to ease their workflows. It further helps them to cross boundaries and boost their credibility within the market.

Moreover, small businesses can gain better access to loans if they have complied with the GST law. Your GST registration can be done easily with the help of all the necessary documents. Further, the GST registration will also provide small businesses with financial benefits, coupled with their streamlined trade.

Following are some important points of GST Registration of small businesses:

-

Improved ease of doing business

-

Unified taxation

-

Composition Scheme

-

Increased credibility

-

Easy access to credit

GST Registration Process Explained

GST Registration Process Explained

GST registration is a necessary process for every dealer whose annual turnover exceeds Rs. 20 Lakh (can vary according to state and kind of supplies).

The GST registration process is an easy and online process, followed by using the government website gst.gov.in. All You need to do is fill out the GST REG-01 Form.

The GST REG-01 form comes in two segments: Part A and Part B. Filing both segments with correct information is mandatory.

According to the GST Act, GST registration can differ for normal taxpayers, casual taxable persons, composition taxpayers and non-resident taxpayers.

The advantage of GST registration makes your business recognized legally and avails all the benefits that come under the GST rule.

FAQs on GST Registration

FAQs on GST Registration

Goods and Services Tax or GST Registration is a process that provides a unique 15-digit number, known as a Goods and Services Tax Identification Number (GSTIN) from the Goods and Services Tax authorities.

The GST Registration helps in establishing a business as reliable and authentic. It also enables the business to operate legally.

It is required within 30 days from the date when anyone's liability arose. However, for a Casual Taxpayer or Non-resident taxable person, five days before starting the business.

Some of the important documents are a PAN card, details of your business, valid email ID and contact number, business bank account details, documentary proof of the constitution of your business and promoters or partners.

No, you don't have to submit the hard copies of documents as the new registration process for GST registration is paperless.

The verification process for the new registration application is done by sending One Time Password (OTP) on the registered mobile number and email ID of the individual/artificial person applying for GST registration.

THEY TRUST US

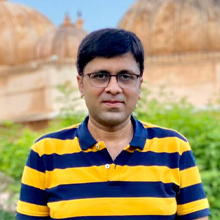

Mr. Rajat Maheshwari

Rajat Gems & Jewellery Pvt. Ltd.

Legal251 is the

best platform for getting consultancy be it in any legal domain they provide

best solution for your query.I am satisfied with their work. What i was

expecting i

got it from Legal251. And I would really appreciate their cooperative work and

how

they deal and cooperate with their customers.

They are the best in business as you may know. There are many complications in

Filing

GST & Income Tax returns for jewellery supply & design business they make all

these

very easy and

efficient.

Mr. Chirag Jain

Director Samrudhi Innovation

For people like

us who are surrounded by work, legal251 is like a gift. Be it a busy day or a

deadline, legal251 can always be counted upon. The customer service is always up

to

the mark and the advices and solutions are always promising. Within 48 hrs of

the

query you can have your solution in your hand and all this, just a few clicks

away

and inside your pocket. Legal work is now on a whole different level.

Mr. Sachin Karma

Co-Founder Today's Bharat

Legal251 changes

the very idea which most people have about getting any legal work done. Making

the

whole process so convenient and also online makes it so easy for everyone to

work

with. If talking about quality work, they have absolutely no match. A platform

as

big as Today's Bharat required a very complete and descriptive terms of

condition

and privacy policy. This was greatly achieved with the help of experts at

Legal251.

Mr. Vipin Soni

Well Known Financial Consultant

I'm thrilled to share my

exceptional

experience

with LEGAL251. Their top priority is evident: providing the best and

speediest solutions. Their professionalism and expertise stood out. The

remarkable speed at which LEGAL251 operates truly sets them apart. Their

responses were prompt and packed with insightful guidance. Any queries

I

had were addressed immediately. For those seeking legal assistance

that's

efficient and of the highest quality, I wholeheartedly endorse

LEGAL251.

Why Choose Legal251 for GST Registration Online?

Why Choose Legal251 for GST Registration Online?

Convenient GST Registration

With Legal251 mobile app or website, users can easily register online just by filling his/her name, email ID, contact number and required service. After your online registration, our team will contact you and further move with the concerned process.

Best Online Platform

Legal251 has one of the biggest online client bases, thus it makes us one of the best online platforms in India, which can help you with your GST Registration. It doesn't matter where you are, we are ready to serve you online.

Best Customer Support

The legal251 team is also known for its complete support and assistance among its clients. We not only will provide you with legal support after your GST registration but we also appreciate your feedback.

Experienced Team

We are familiar with the GST registration process as we already have more than 10 years of experience. Thus, choosing us will benefit you by working with experienced experts, that will ease and smooth the process of your GST Registration.

On-time Service

Our team is ready to provide you with on-time service without any delay. We know the value of your time thus without wasting any time we immediately start working on your GST registration process.

Pocket-friendly Services

We offer nominal and pocket-friendly services without any compromise on the quality of the work. With your every investment in our service, we make sure that your satisfaction and budget are our priority.

We are here to help you! Chat with us on WhatsApp for any queries or more.