E-Filing Income Tax

Directly fill out any Tax Returns like salary, capital gains, business, professional or property taxes. Get comprehensive Tax return services at your fingertips.

Documenting income tax returns is each resident's obligation. The IT division confirms these

assertions of salary and if any sum has been paid in abundance, the office discounts the

sum to the concerned person's financial balance. Ensure your safe and secure filing of all

income tax and become a responsible citizen. Legal251 helps you not miss any important

documents and get things done for you in a few clicks.

An income tax return is a form where taxpayers declare their taxable income, deductions and

tax payments. This procedure of filing income tax return is referred to as income tax

filing. While filing, the total income tax you owe to the government is also calculated. If

you've paid more tax than needed for the financial year, the IT Department will refund the

extra money to your account.

Documenting income tax returns is each resident's obligation. The IT division confirms these

assertions of salary and if any sum has been paid in abundance, the office discounts the

sum to the concerned person's financial balance. Ensure your safe and secure filing of all

income tax and become a responsible citizen. Legal251 helps you not miss any important

documents and get things done for you in a few clicks.

An income tax return is a

form where taxpayers declare their taxable income, deductions and tax payments. This

procedure of filing income tax returns isreferred to as income tax filing. While filing,

the total income tax you owe to the government is also calculated. If you've paid more tax

than needed for the financial year, the IT Department will refund the extra money to your

account.

0 Years

Of Experience

0 +

Cases Solved

0 +

Awards Gained

0 k +

Trusted Clients

0 k+

Queries Solved

Name:

Email:

Contact no:

Select Location:

Starter

Select the Tenure:

basic

Select the Tenure:

pro

Select the Tenure:

pro+

Select the Tenure:

Select the Tenure:

Starter

Select the Tenure:

basic

Select the Tenure:

pro

Select the Tenure:

Select the Tenure:

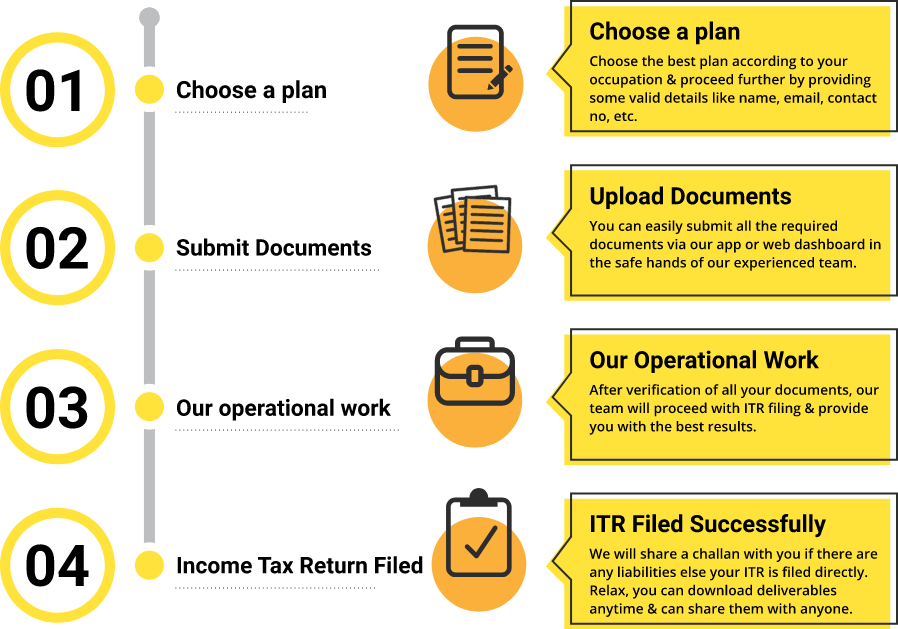

How to E-File Income Tax Returns

How to E-File Income Tax Returns

Benefits of Using Legal251 for Income Tax Returns E-Filing

Benefits of Using Legal251 for Income Tax Returns E-Filing

Efficient Time Saving

Comfort of Filing From Anywhere

Simple, Easy and Faster Process

Obtaining Valid Documentation

Avoid Penalties

Decreased complex process

Post Purchase Service Support

Best Virtual Assistance

Income Tax Returns E-Filing for Individuals and Businesses

Income Tax Returns E-Filing for Individuals and Businesses

Income Tax filing is important for every taxpayer whether you are an individual or business owner. According to the age of an individual and their gross annual income, the eligibility for Income Tax is decided. To file an ITR, individuals and businesses can use the ITR-3 or ITR-4 form.

The income for ITR-4 has to be calculated by the presumptive tax method or the conventional way. ITR filing helps you manage and record your paid taxes for the current year according to your income slab.

Every business or company has to file their income tax returns even if they are suffering a loss. In the same situation, self-employed people do not need to file income tax for that particular year. Moreover, late filing fees are applicable for both individuals and businesses.

It must be noted that for every taxpayer, e-filing provides speed, security, convenience and also saves time. It further reduces the burden of the income tax department with an alternative to traditional paper filing.

Here are some important points related to ITR E-filing for Individuals and Businesses:

-

Saves time

-

Hassle-free process

-

A good alternative to traditional ITR filing

-

User-friendly interface

-

Easy verification process

-

Real-time tracking facility

Documents Required for ITR E-Filing

Documents Required for ITR E-Filing

ITR Filing

Don't have all these documents?

We will

help you in preparing these documents

Just call on

Importance of Timely Income Tax E-Filing

Importance of Timely Income Tax E-Filing

The timely Income Tax return filing process is important for every taxpayer as it can provide you the benefit of avoiding penalties and punishments. If you need any loan for your business then the complete ITR filing can make it easy.

The process further benefits you, as the ITR filing document can work as income proof. In case you are required to show such proofs, then you can easily use the ITR filing for the same. While opting for E-filing of your ITR, unlike traditional filing procedures, you can track your filing process and keep every single update until the process is completed.

Additionally, on-time filing will also benefit you in carrying or bringing forward your losses of the current year. On the other hand, it will speed up the visa processing as it has smoothened the documentation process when you apply for the visa.

Income Tax E-Filing Process Explained

Income Tax E-Filing Process Explained

Income Tax filing is important for every taxpayer whether you are an individual or business owner. According to the age of an individual and their gross annual income, the eligibility for Income Tax is decided. To file an ITR, individuals and businesses can use the ITR-3 or ITR-4 form.

After you have submitted your documents our team will go through them carefully and will inform you if any changes are required to avoid mistakes

Our best ITR filing experts are here to deal with document necessities & fulfilment of filing.

Experts will carefully look into your expenses and income information so that they consult you regarding this.

Based on your respective plan relevant experts will prepare your Income Tax Return.

At last, we will file an Income Tax Return on your behalf and share all the deliverables with you.

Common Mistakes to Avoid in Income Tax E-Filing

Common Mistakes to Avoid in Income Tax E-Filing

-

Incorrect personal details

-

Selecting the wrong ITR form

-

Failing to report all income sources

-

Neglecting eligible deductions and exemptions

-

Late filing or non-filing

-

Discrepancy in Form 26AS and Income Details

-

Not Verifying Before Submission

-

Incomplete Disclosure of Assets

FAQs on Income Tax Return

FAQs on Income Tax Return

The online process of filing income tax is known as Income Tax e-filing which allows every taxpayer to calculate their tax liability with some additional benefits.

The eligibility criteria for filing an Income Tax return works according to the Income Tax Act. All those taxpayers whose age is less than 75 years and earn over Rs. 2.5 Lakh are eligible for filing the Income tax.

Yes, you are eligible to file the Income Tax return voluntarily even if your income is less than the basic exemption limit.

For non-payment or delayed payment of ITR late filing fee will be applicable while the maximum penalty will not exceed Rs. 5,000/-.

The key benefits of filing ITR are easy loan approval, a fast visa process, claiming tax refunds and many more.

Under section 139, the ITR must be filed only if you are liable for filing. If you own a PAN card and are not liable for filing ITR then it is not mandatory.

Under Section 10(1) of the Income Tax Act, the income from agriculture and farming is exempted from any tax.

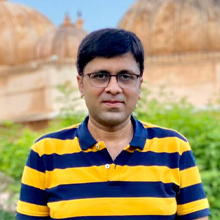

THEY TRUST US

Mr. Rajat Maheshwari

Director Rajat Gems & Jewellery Pvt. Ltd.

Legal251 is

the

best platform for getting consultancy be it in any legal domain they

provide

best solution for your query.I am satisfied with their work. What i was

expecting i

got it from Legal251. And I would really appreciate their cooperative

work

and

how

they deal and cooperate with their customers.

They are the best in business as you may know there are many problems in

Film

industries be it in trademarks and copyrights they make all these very

easy

and

efficient.

Mr. Chirag Jain

Director Samrudhi Innovation

For people

like

us who are surrounded by work, legal251 is like a gift. Be it a busy day

or

a

deadline, legal251 can always be counted upon. The customer service is

always up

to

the mark and the advices and solutions are always promising. Within 48

hrs

of

the

query you can have your solution in your hand and all this, just a few

clicks

away

and inside your pocket. Legal work is now on a whole different

level.

Mr. Sachin Karma

Co-Founder Today's Bharat

Legal251

changes

the very idea which most people have about getting any legal work done.

Making

the

whole process so convenient and also online makes it so easy for

everyone to

work

with. If talking about quality work, they have absolutely no match. A

platform

as

big as Today's Bharat required a very complete and descriptive terms of

condition

and privacy policy. This was greatly achieved with the help of experts

at

Legal251.

Mr. Vipin Soni

Well Known Financial Consultant

I'm thrilled to share my exceptional

experience

with

LEGAL251. Their top priority is evident: providing the best and

speediest

solutions. Their professionalism and expertise stood out. The remarkable

speed

at which LEGAL251 operates truly sets them apart. Their responses were

prompt

and packed with insightful guidance. Any queries I had were addressed

immediately. For those seeking legal assistance that's efficient and of

the

highest quality, I wholeheartedly endorse LEGAL251.

Why Choose Legal251 for Income Tax E Filing?

Why Choose Legal251 for Income Tax E Filing?

Simple process

With Legal251 users can easily register online just by filling his/her name, email ID, contact number and required service. This makes it convenient for users to sign up and get started with their services.

Best Online Platform

Legal251’s online platform allows for accessibility from anywhere, making it convenient for its clients regardless of their location.

Best Legal Support

The legal251 team also provides complete support and assistance to its clients. We not only provide you with legal support after your ITR filing but also appreciate your feedback.

Experienced Team

We are familiar with the taxation industry as we already have more than 10 years of experience in the same. Thus choosing us will benefit you in working with experienced tax experts. That will ease and smooth the process of filing your Income Tax Return.

On-time Service

Our team is ready to provide you with on-time service without any delay. We know that the promise of delivering services on time reflects respect for clients' time and commitments.

Pocket-friendly Legal Services

Legal251 offers affordable ITR services, which is a significant advantage, making professional assistance accessible to a broader range of clients.

We are here to help you! Chat with us on WhatsApp for any queries or more.