Online GST Return Filing

Legal251 has a team of specialists when it comes to GST return filing. GST Return Filing service plans rely upon the kind of professional customary, trade, import, charge deductor, the number of solicitations, charges and exchanges in your business every month. We are here to help you not miss deadlines or get fined a high amount. Hire truly dedicated professionals who always put you on the safer side.

Know more about GST & Registration

Plans

Plans

Please select Turnover:

Name:

Email:

Contact no:

Select Location:

Starter

Select the Tenure:

Requirements:-

or

Inclusions:-

basic

Select the Tenure:

Requirements:-

or

Inclusions:-

pro

Select the Tenure:

Requirements:-

Inclusions:-

(on basis of

Invoices)

Select the Tenure:

Requirements:-

Inclusions:-

(on basis of

Invoices)

Starter

Select the Tenure:

Requirements:-

or

Inclusions:-

basic

Select the Tenure:

Requirements:-

or

Inclusions:-

pro

Select the Tenure:

Requirements:-

Inclusions:-

(on basis of

Invoices)

Select the Tenure:

Requirements:-

Inclusions:-

(on basis of

Invoices)

Starter

Select the Tenure:

Requirements:-

or

Inclusions:-

basic

Select the Tenure:

Requirements:-

or

Inclusions:-

Starter

Select the Tenure:

Requirements:-

or

Inclusions:-

basic

Select the Tenure:

Requirements:-

or

Inclusions:-

Starter

Select the Tenure:

Requirements:-

or

Inclusions:-

basic

Select the Tenure:

Requirements:-

or

Inclusions:-

ENTERPRISE SOLUTION

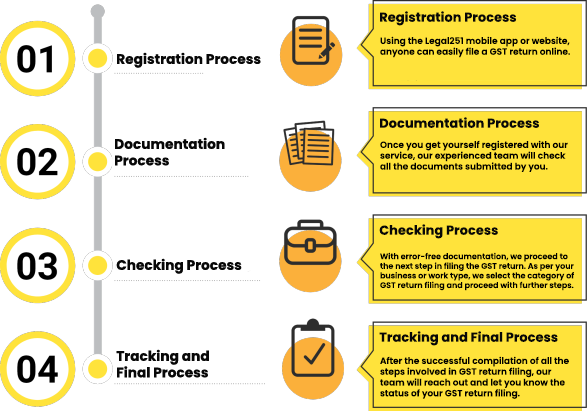

How to File GST Returns Online

How to File GST Returns Online

Types of

forms

Types of

forms

GSTR-1

The GSTR-1 is a monthly return form filed by businesses to

report the details of the outward supplies of all services and goods. Every GST-registered

entity should file GSTR-1 except Input service distributor and Composition taxpayer. It

must

be filed even if there is no business activity. The due date for filing GSTR-1 is 10th of

every month.

GSTR 1 acts as the basis for all other form submissions for the month.

Benefits of Using Legal251 for GST Return Filing

Benefits of Using Legal251 for GST Return Filing

Time Effective Process

Accuracy in Filing

Team of Experts

Assured Complete Compliance

Budget Friendly

Simplifying GST Return Filing

No Hidden Charges

24x7 Customer Support

Importance of Timely GST Return Filing

Importance of Timely GST Return Filing

GST return filing is a vital process for GST-registered businesses that need to comply with tax regulations imposed by the government. Filing a GST return on time is vital as it can help you avoid penalties, claim input tax credit and increase your creditworthiness. Regularly filing GST returns can also minimize the audit risk and facilitate your business's expansion.

Following are some of the importance of filing GST Returns on time:-

-

Compliance with Legal Requirements

-

Input Tax Credit Availability

-

Avoidance of Late Fees and Penalties

-

Maintaining a Good Business Reputation

-

Avoidance of Business Disruptions

-

Facilitates Government Revenue Collection

Common Mistakes to Avoid in GST Return Filing

Common Mistakes to Avoid in GST Return Filing

-

Lack of documentation

-

Inaccurate invoice details

-

Any difference in GSTR-2A and GSTR-3B

-

Avoid Incomplete or inaccurate data entry

-

Missing the GST return due dates

-

Not validating GSTIN of suppliers

-

Incorrect classification of tax

-

Non-Compliance with GST Rules and Updates

GST Return Filing for Small Businesses

GST Return Filing for Small Businesses

GST return filing for small businesses may appear to be difficult. However, small business owners can navigate it effectively with a certain comprehension of the cycle, valid record-keeping and the use of accounting software. Appropriate and exact documentation of GST returns isn't just a lawful commitment but also a way to guarantee that your business stays consistent. It can avoid punishments and adds to an improved and straightforward expense system in our country.

Documents Required for GST Return Filing

Documents Required for GST Return Filing

You will require all the following documents for GST return filing:-

GST Return Filing

or

or

or

or

Don't have all these documents?

We will

help you in preparing these documents

Just call on

FAQs on GST Return Filing

FAQs on GST Return Filing

GST returns essentially stands for filing of all GST. Every individual who is covered under the GST Act must produce their income to the Tax Department of India. This is known as return and it includes details of every sale and purchase.

You can easily upload all your documents using our web dashboard or app and can easily review them later and share them with anyone.

No, a person without GST registration can neither collect GST from his customers nor can claim any input tax credit of GST paid by him.

Threshold Limit – Cash payment exceeding Rs 10,000 to a person in a single day. The limit is extended to Rs. 35,000 in case the payments are being made for plying, hiring or leasing of goods carriage to a person in a single day.

Composition dealers need to pay nominal tax rates based on the type of business (a maximum of 2% for manufacturers, 5% for the restaurant service sector and 1% for other suppliers).Small businesses with an annual turnover of less than Rs. 1.5 crore (Rs. 75 Lakhs for the Special Category States) can opt for the Composition scheme.

Late filing attracts penalty called late fee.

The late fee is Rs. 100 per day per Act. So it is 100 under CGST & 100 under

SGST. Total will be Rs. 200/day*. The maximum is Rs. 5,000. There is no late fee

on IGST in case of delayed filing.

Along with late fee, interest has to be paid at 18% per annum. It has to be

calculated by the taxpayer on the tax to be paid. The time period will be from

the next day of filing to the date of payment.

You will be required to register under GST, even if your business' annual revenue is less than Rs 20 lakh, which is the threshold for businesses which are required to be registered under GST.

The GST replaces numerous different indirect

taxes such as:

Central Excise Duty

Service Tax

Countervailing Duty

Special Countervailing Duty

Value Added Tax (VAT)

Central Sales Tax (CST)

Octroi

Entertainment Tax

Entry Tax

Purchase Tax

Luxury Tax

Advertisement taxes

Taxes applicable on lotteries.

The same return form can be used for filing SGST, CGST and IGST. It will have different columns for each one of them and it will have to be filled on the basis of inter-state or intra-state supplies.

In case you delay the filing of the return, you will have to pay Rs.100 per day as a late fee. The maximum late fee charge will be Rs.5000.

THEY TRUST US

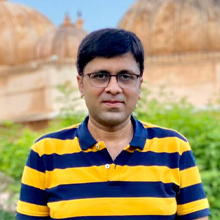

Mr. Rajat Maheshwari

Director Rajat Gems & Jewellery Pvt. Ltd.

Legal251 is the

best platform for getting consultancy be it in any legal domain they provide

best solution for your query.I am satisfied with their work. What i was

expecting i

got it from Legal251. And I would really appreciate their cooperative work and

how

they deal and cooperate with their customers.

They are the best in business as you may know. There are many complications in

Filing

GST & Income Tax returns for jewellery supply & design business they make all

these

very easy and

efficient.

Mr. Chirag Jain

Director Samrudhi Innovation

For people like

us who are surrounded by work, legal251 is like a gift. Be it a busy day or a

deadline, legal251 can always be counted upon. The customer service is always up

to

the mark and the advices and solutions are always promising. Within 48 hrs of

the

query you can have your solution in your hand and all this, just a few clicks

away

and inside your pocket. Legal work is now on a whole different level.

Mr. Sachin Karma

Co-Founder Today's Bharat

Legal251 changes

the very idea which most people have about getting any legal work done. Making

the

whole process so convenient and also online makes it so easy for everyone to

work

with. If talking about quality work, they have absolutely no match. A platform

as

big as Today's Bharat required a very complete and descriptive terms of

condition

and privacy policy. This was greatly achieved with the help of experts at

Legal251.

Mr. Vipin Soni

Well Known Financial Consultant

I'm thrilled to share my exceptional experience with

LEGAL251. Their top priority is evident: providing the best and speediest

solutions.

Their professionalism and expertise stood out. The remarkable speed at which

LEGAL251 operates truly sets them apart. Their responses were prompt and packed

with insightful guidance. Any queries I had were addressed immediately. For

those

seeking legal assistance that's efficient and of the highest quality, I

wholeheartedly endorse LEGAL251.

Why Choose Legal251 for GST Return Filing Online?

Why Choose Legal251 for GST Return Filing Online?

Convenient GST Return Filing

Legal251 is a convenient platform that can save time and effort. The process of GST Return Filing with our expert team is user-friendly and it streamlines the same.

Best Online Platform

Legal251 is a user-friendly, secure and efficient online platform for filing GST returns. It is intuitive and easy to navigate the process of GST Return with Legal251.

Best Customer Support

Legal251 has responsive and helpful customer support, which can be a lifesaver if you encounter any issues or have questions during the GST filing process. It ensures a smoother experience.

Experienced Team

Legal251 has An experienced team that provides awareness, expertise and accuracy in handling your GST return filings. Our team's knowledge of GST laws and regulations is a key factor for effective GST Return filing.

On-time Service

As we understand timeliness is crucial for compliance with GST Return Filing. Filing returns punctually avoids penalties and keeps your business in good standing with the authorities and regulations.

Pocket-friendly Services

Cost-effectiveness is something on which we have our expertise. Legal251’s competitive pricing or packages that offer value for money can be a significant factor in choosing your GST Return Filing service.

Hi we are Online!

We are here to help you! Chat with us on WhatsApp for any queries or more.