200k+ people trust us

200k+ people trust us

Section 8 Company Registration

Get Section 8 Registration

@

Rs.9251 only /- ( Including GST)Terms & Condition

Government fees & stamp duties extra. Please fill form to get detailed quote in seconds.

In 2 Weeks . Transparent Pricing . No Hidden Cost

Get Absolutely Free In Package

Pan & TAN Registration

DIN and DSC for Directors

Complete Documentation

Personal Assistance

PF and ESIC Registration

Get Quote Instantly

Name *

Contact Number *

Email *

City/district *

0 Years

Of Experience

0 +

Cases Solved

0 +

Awards Gained

0 k +

Trusted Clients

0 k+

Queries Solved

A Section 8 Company is a non-profit organisation that aims to promote sports, education, research, social welfare, art, science, and protection of the environment, etc. The concept of such companies is introduced under section 8 of the Companies Act, 2013.

The restriction on these companies is that these companies are permitted to use the profits only for the purpose for which the company was promoted. To register such a company or organisation, a minimum of two directors are required, and there is no requirement for a minimum paid-up capital to set up such a company in India.

Get your non-profit entity registered today with Section 8 Company Registration from Legal251! Our easy-to-use platform lets you quickly register and enjoy numerous tax benefits. Please use our reliable service and worry-free registration process to become a legally registered non-profit entity!

All Service Comparison

Proprietorship vs Limited Liability Partnership (LLP) vs Company

Features

Proprietorship

Partnership

LLP

Company

Definition

A sole proprietorship is a business owned and operated by a single individual.

A partnership is a legal arrangement where two or more individuals or entities agree to share ownership, responsibilities, profits, and liabilities of a business.

An LLP is a hybrid business structure that combines elements of partnerships and company. It offers limited liability to its partners, protecting their personal assets from the liabilities of the business.

A company is a legal entity that exists separately from its owners (shareholders). It can be a private limited company or a public limited company. Shareholders' are the owners of the company and their liability is limited to their investment, and the company's operations and management are governed by the board of directors.

Ownership

In a proprietorship, a single individual owns and manages the business.

A partnership involves two or more individuals (partners) who share ownership and management responsibilities.

Partners have limited liability, meaning their personal assets are generally protected from business debts or liabilities.

A company is a legal entity separate from its owners (shareholders). Shareholders have limited liability, and their personal assets are not typically at risk for company debts.

Registration Time

7-15 working days

Promoter Liability

Unlimited Liability

Limited Liability

Governance

Governed by Local Laws

Under Partnership Act, 1932

LLP Act, 2008

Under Companies Act,2013

Compliance Requirements

Compliance in accordance with- Income Tax Laws and other Local Laws

Compliance in accordance with- Income Tax Laws and other Local Laws

Compliance in accordance with-Income Tax Laws, Local Laws, Companies Act and other as applicable

Compliance in accordance with-Income Tax Laws, Local Laws, Companies Act and other as applicable

Taxation

Income is taxed at the individual's income tax rates.

Income is generally taxed at the individual partners' income tax rates.

Taxed as a partnership, where partners are individually taxed on their share of profits.

Subject to corporate tax rates. Shareholders are taxed on dividends received.

Legal recognition

Section 8 Companies are recognized and governed by the Companies Act, 2013. It provides them with a legal framework and legitimacy as an independent legal entity.

Limited liability

The liability of the members or shareholders of a Section 8 Company is limited. In case of any debts or liabilities, the personal assets of the members are not at risk. This feature provides financial security to the promoters and encourages them to contribute towards social welfare activities.

Tax exemptions

Section 8 Companies enjoy various tax benefits. They are exempt from paying income tax on the surplus income generated from their charitable or social welfare activities. Additionally, donors contributing funds to such organisations are eligible for tax deductions under Section 80G of the Income Tax Act.

Eligibility for foreign donations

Section 8 Companies can receive foreign contributions and donations under the Foreign Contribution (Regulation) Act (FCRA). This enables them to access global funding for their charitable initiatives.

Perpetual existence

Section 8 Companies have a perpetual existence, meaning they can continue their operations and carry out their objectives even if the founding members resign or pass away. This ensures the continuity of their social welfare activities and long-term impact.

Credibility and trust

Registration as a Section 8 Company enhances the credibility and trustworthiness of the organisation. It assures stakeholders, including donors, volunteers, and beneficiaries, that the company is committed to social causes and operates with transparency and accountability.

Access to grants and funding

Section 8 Companies are eligible to apply for grants, funding, and schemes offered by government departments, corporate entities, and international organisations. This financial support aids in the implementation and expansion of their social initiatives.

Greater reach and impact

Section 8 Companies have wider visibility and recognition in society. They can collaborate with government bodies, NGOs, and other stakeholders to address social issues and make a positive impact on communities at large.

L ve From

ve From

Our Clients

Our customers love the convenience of filing with us and appreciate our expertise in getting their Legal work done on time. We value the trust our clients place in us, and we strive to provide them with the best service possible.

Kailash Chandra Verma

Proprietor , Balaji Apparels

"Amazing Platform"

Filing my GST returns had been an absolute nightmare until I found Legal251. The interface is so easy to use, it makes filing my returns on time a breeze. I can easily keep track of all my invoices and payments and Legal251 experts even provides helpful tips for me to make sure that everything is done correctly. Thanks to Legal251 team, filing GST returns has become stress-free!

Virendra Vishwkarma

Founder, Tirth Enterprises

"Highly recommended!"

I was having a hard time filing my GST returns and was really confused as to how to go about it. That's when I came across Legal251. They were thorough professionals who made sure that my documents were filed perfectly without any errors. Their customer service was also top-notch and they guided me through the entire process with ease. I'm glad that I chose Legal251 for filing my GST returns. Highly recommended!

Priyanka Agnihotri

CEO, 9 Telecom and Security

"Extremely Impressed"

I've been using Legal251 for filing my GST returns for the past few months and I'm extremely impressed with their service and platform. It's so easy to use, and all the necessary information is provided in a very organized way. Plus, filing my returns on time has become so much easier with this platform. Highly recommend Legal251 for anyone looking for an efficient way to file their GST returns.

Monu Panchal

Founder , Mishi Industries

"Excellent Knowledge "

I was a bit worried when filing my GST return for the first time, but Legal251 made it a breeze. Their team of experts guided me through every step and filed my return perfectly. I'm really glad I chose Legal251 to help me with this task as they have an excellent knowledge of the regulations and ensured that everything was done correctly. Thank you!

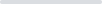

Our team will look into the documents that you have submitted, reviewing any false or mistaken information to keep you comfortable.

Our best experts are here to deal with document necessities & to fulfil your registration needs.

The respective expert will proceed further with your documents in order to apply for your Section 8 Company Registration.

After our team completes DSC, DIN, and formalities, patiently wait for ROC to issue your COI.

We'll share the COI and unique CIN from ROC, officially establishing the Section 8 Company Registration's existence.

FREQUENTLY ASKED QUESTIONS

- A minimum of two shareholders (individuals or corporate entities).

- A minimum of two directors (individuals).

- At least one of the directors must be a resident of India.

- The proposed company must have a unique name.

Growth & Improvement

We believe in growth and improvement at all costs. For us, growth is the law of life and it shall be fulfilled. We know the importance of business and its growth for you.

Support & Availability

We feel how much pain even a small problem or query can cause, that is the reason we are available to support you and solve any of such problems at every particular instance in time.

Experienced Team

All the members of our team are experienced individuals who believe in professionalism and customer satisfaction above all. Each one of them is passionate in their respective fields.

Focus

Any assigned task is of utmost importance to us, that's why our team members are always focused on taking care of even the smallest of our clients' needs and requirements.

Value for Money

We understand that the money being spent is hard-earned, therefore we utilize every single penny that you pay us in the most effective way possible hence providing the best value for money.

Care & Regards

We believe you to be a part of this family and that all your problems, as well as achievements, are our very own. Your interests are ours and their fulfillment is at the top in our regards.

Hi we are Online!

We are here to help you! Chat with us on WhatsApp for any discount queries or more.