Online ESIC Return Filing Service | File ESIC return online before the Due Date

In India, the Employee State Insurance Corporation (ESIC) plays a pivotal role in providing social security and health insurance to employees. With the advancement of digital platforms, ESIC has introduced online facilities to streamline processes for employers and ensure accurate filing of returns. This digital transformation aims to help businesses automate their ESIC return filing process, ensuring timely and efficient compliance with the regulations set forth by the Employees’ State Insurance Act

In line with this digital evolution, Legal251 provides an online platform that simplifies the ESIC return filing process. Through our platform, employers can seamlessly submit their ESIC returns, facilitating compliance with regulatory requirements while minimizing paperwork and administrative burdens. Our user-friendly interface and comprehensive features ensure that one can fulfill their obligations effortlessly, contributing to a smoother and more efficient business operation.

Know more about GST & Registration

Plans

Plans

Please Select the Number of Employees:

Name:

Email:

Contact no:

Select Location:

₹1000/Monthly

₹.00 Save

Tasks Included:-

Additional Facilities:-

₹1500/Monthly

₹.00 Save

Tasks Included:-

Additional Facilities:-

₹2500/Monthly

₹.00 Save

Tasks Included:-

Additional Facilities:-

₹3000/Monthly

₹.00 Save

Tasks Included:-

Additional Facilities:-

₹4000/Monthly

₹.00 Save

Tasks Included:-

Additional Facilities:-

ENTERPRISE SOLUTION

₹350/Monthly

₹.00 Save

Tasks Included:-

Additional Facilities:-

Understanding ESIC Return Filing and Its Importance for Employee

Understanding ESIC Return Filing and Its Importance for Employee

ESIC return filing is a mandatory obligation for employers covered under the ESIC scheme. It involves the accurate reporting of monthly contributions towards the ESIC fund, which provides financial assistance to employees during times of need, such as illness, injury, or death due to employment-related incidents. Timely and accurate filing of ESIC returns ensures compliance with legal regulations and helps secure employees' social security benefits.

-

Social Security

-

Healthcare Coverage

-

Financial Protection

-

Retirement Benefits

-

ESIC extends coverage to employees' families

-

Employee Well-being

-

Legal Protection

Ensuring Compliance with ESIC Scheme Regulations

Ensuring Compliance with ESIC Scheme Regulations

Compliance with ESIC regulations is crucial for employers to avoid penalties and legal repercussions. The Ministry of Labour and Employment oversees the implementation of ESIC regulations, and non-compliance can result in fines or other penalties. Regular filing of ESIC returns using the online platform helps businesses stay compliant and avoid any adverse consequences.

Failure to comply can lead to more than just financial setbacks; it can tarnish a company's reputation and erode employee trust. The repercussions of non-compliance extend beyond mere fines. They can include legal actions that may disrupt operations and damage long-term viability.

Regular filing of ESIC returns through the convenient online platform isn't just a bureaucratic chore; it's a proactive step towards maintaining compliance and protecting the welfare of your workforce. By embracing ESIC regulations as a fundamental aspect of responsible business conduct, employers demonstrate their commitment to their employees' well-being and dedication to upholding legal standards. Compliance isn't just about avoiding penalties; it's about fostering a culture of accountability and integrity within the organization.

Essential Documents Required for ESI Return Filing

Essential Documents Required for ESI Return Filing

To file returns with the ESIC department, employers must ensure they have all the necessary documents in place. These documents typically include employee details, salary records, contribution statements, and other relevant information mandated by the ESIC regulations. Legal251 ensures all required documents are accurate and prepared for filing. Following are the list of required documents:-

-

Certificate of registration

-

Certificate of incorporation

-

PAN card of the organization and its employees

-

Memorandum of association and articles of association of the company

-

A cancelled cheque

-

List of all employees employed by the company and their salary details

-

List of all shareholders and directors of the company

-

Proof of address of the establishment

Benefits of Filing ESIC Returns Online

Benefits of Filing ESIC Returns Online

The introduction of online ESIC return filing brings numerous benefits to employers. It provides a fast and efficient solution for businesses to prepare and file their returns within the stipulated deadlines. By leveraging the ESIC portal, employers can automate the filing process, reducing the risk of late filing penalties and ensuring compliance with ESIC regulations.

Timely Filing: Due Date for ESIC Returns

Timely Filing: Due Date for ESIC Returns

Filing ESIC returns before the due date is essential to avoid penalties for late filing. Employers must ensure they submit their returns within the prescribed timeframe, typically on a monthly or half-yearly basis, depending on the ESIC regulations applicable to their business.

The last date to pay your ESI contribution is the 15th of every month. Employers registered under the scheme should deposit the due amount in a bank authorized by the statutory body before the deadline.

ESIC requires the submission of half-yearly returns for two six-month periods. Returns covering April 1st to September 30th must be filed by November 12th, and returns from October 1st to March 31st are due by May 12th annually.

Step-by-Step Procedure for ESI Return Filing Online

Step-by-Step Procedure for ESI Return Filing Online

The process for filing ESIC returns online involves several steps. Employers must log in to the ESIC website or portal and navigate to the section for return filing. They then enter the required details, such as employee information, salary records, and contribution amounts. After verifying the accuracy of the information provided, employers can submit the return electronically to the ESIC department. Flowing is the short description, as to the steps involved in ESI Return filing:

-

Log in to the ESIC portal using your credentials.

-

Navigate to the "File Monthly Contribution" section

-

Enter the relevant details such as employee wages and contributions

-

Verify the information entered for accuracy.

-

Generate the challan for payment.

-

Make the payment through the available options.

-

Obtain the acknowledgment receipt.

-

Submit the return on the portal.

-

Download the filed return for record-keeping purposes.

Ensuring Compliant Practices with ESIC Act

Ensuring Compliant Practices with ESIC Act

Compliance with the Employees' State Insurance Act is paramount for employers to avoid legal liabilities and penalties. The ESIC Act outlines the rights and obligations of both employers and employees covered under the scheme. Employers must adhere to the provisions of the ESIC Act and ensure timely filing of returns, payment of contributions, and adherence to other regulatory requirements.

Employers may seek assistance from ESIC experts or consultants to navigate the complexities of ESIC return filing. These experts can provide guidance on the filing process, help resolve any issues or discrepancies, and ensure accurate compliance with ESIC regulations. Leveraging expert support can streamline the filing process and minimize the risk of errors or omissions.

Streamlining the Payment of ESIC Contributions

Streamlining the Payment of ESIC Contributions

Payment of ESIC contributions is a critical aspect of compliance with the ESIC scheme. Employers must ensure they deposit the requisite amount of contribution payable to their employees within the prescribed timeframe. Failure to pay contributions on time can result in penalties or other consequences imposed by the ESIC department.

Online ESIC return filing offers numerous benefits for employers, including accuracy, efficiency, and compliance with ESIC regulations. By leveraging digital platforms and expert assistance, employers can streamline the filing process, ensure timely compliance, and maximize the benefits of the ESIC scheme for their employees. Employers need to stay updated on ESIC regulations and fulfill their obligations to provide social security coverage to their workforce.

Exploring ESIC Contribution and its Significance

Exploring ESIC Contribution and its Significance

ESIC contribution plays a vital role in financing the social security benefits provided to employees. Employers are required to pay contributions to the ESIC fund based on the salary of their employees. The amount of contribution payable is calculated as a percentage of the employee's wages and must be deposited with the ESIC within 15 days from the date of the contribution period. Following are some of the Significance of ESIC:-

-

ESIC (Employee State Insurance Corporation) contribution is a statutory deduction from employees' salaries.

-

Employers also contribute a certain percentage of their payroll to ESIC.

-

These contributions fund the ESIC scheme, providing employees with benefits such as medical, sickness, maternity, and disability benefits.

-

ESIC contribution ensures financial protection for employees and their dependents during times of need.

-

It promotes employee welfare and supports a healthy workforce, enhancing productivity.

-

Compliance with ESIC contribution regulations is mandatory for employers, helping them avoid legal penalties and maintain a positive reputation.

-

Regular payment of ESIC contributions is essential for the sustainability of the scheme and the welfare of employees.

Frequently Asked Questions

Frequently Asked Questions

ESIC return filing involves submitting details of employees' wages and contributions to the Employee State Insurance Corporation (ESIC) for a specified period.

Employers covered under the ESIC Act, who have registered their establishments with ESIC, need to file ESIC returns.

ESIC returns need to be filed half-yearly, covering two six-month periods: April 1st to September 30th and October 1st to March 31st.

You'll need details of employees' wages, contributions made by both employees and employers and other relevant information required by the ESIC portal.

Returns for the period from April 1st to September 30th must be filed by November 12th, and returns for the period from October 1st to March 31st are due by May 12th each year.

Failure to file ESIC returns on time may result in penalties, fines, or legal actions imposed by ESIC authorities.

ESIC returns can be filed online through the ESIC portal using your login credentials. You need to enter the required information accurately, verify it, generate the challan for payment, make the payment, submit the return, and obtain acknowledgment.

Yes, you can revise ESIC returns within a specified time frame if there are errors or discrepancies in the initial filing.

ESIC provides support through its helpline numbers, online tutorials, user manuals, and help sections on the ESIC portal. Additionally, you can seek assistance from ESIC consultants or experts for guidance on ESIC return filing.

THEY TRUST US

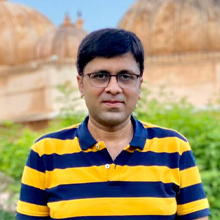

Mr. Rajat Maheshwari

Director Rajat Gems & Jewellery Pvt. Ltd.

Legal251 is the

best platform for getting consultancy be it in any legal domain they provide

best solution for your query.I am satisfied with their work. What i was expecting i

got it from Legal251. And I would really appreciate their cooperative work and how

they deal and cooperate with their customers.

They are the best in business as you may know. There are many complications in

Filing

GST & Income Tax returns for jewellery supply & design business they make all these

very easy and

efficient.

Mr. Chirag Jain

Director Samrudhi Innovation

For people like

us who are surrounded by work, legal251 is like a gift. Be it a busy day, or a

deadline, legal251 can always be counted upon. The customer service is always up to

the mark and the advices and solutions are always promising. Within 48 hrs of the

query you can have your solution in your hand, and all this, just a few clicks away

and inside your pocket. Legal work is now on a whole different level.

Mr. Sachin Karma

Co-Founder Today's Bharat

Legal251 changes

the very idea which most people have about getting any legal work done. Making the

whole process so convenient and also online makes it so easy for everyone to work

with. If talking about quality work, they have absolutely no match. A platform as

big as Today's Bharat required a very complete and descriptive terms of condition

and privacy policy. This was greatly achieved with the help of experts at

Legal251.

Mr. Vipin Soni

Well Known Financial Consultant

I'm thrilled to share my exceptional experience with

LEGAL251.

Their top priority is evident: providing the best and speediest solutions. Their

professionalism and expertise stood out. The remarkable speed at which LEGAL251

operates

truly sets them apart. Their responses were prompt, and packed with insightful

guidance.

Any queries I had were addressed immediately. For those seeking legal assistance

that's

efficient and of the highest quality, I wholeheartedly endorse LEGAL251.

Growth & Improvement

We believe in growth and improvement at all costs. For us, growth is the law of life and it shall be fulfilled. We know the importance of business and its growth for you.

Support & Availability

We feel how much pain even a small problem or query can cause, that is the reason we are available to support you and solve any of such problems at every particular instance in time.

Experienced Team

All the members of our team are experienced individuals who believe in professionalism and customer satisfaction above all. Each one of them is passionate in their respective fields.

Focus

Any assigned task is of utmost importance to us, that's why our team members are always focused on taking care of even the smallest of our clients' needs and requirements.

Value for Money

We understand that the money being spent is hard-earned, therefore we utilize every single penny that you pay us in the most effective way possible hence providing the best value for money.

Care & Regards

We believe you to be a part of this family and that all your problems, as well as achievements, are our very own. Your interests are ours and their fulfillment is at the top in our regards.

We are here to help you! Chat with us on WhatsApp for any discount queries or more.