TDS Return Filing

Legal251 has the team of a specialist when it comes to TDS return filing. TDS return filing is a quarterly statement that is to be given to the Income Tax department. It is necessary to submit the TDS returns on time. TDS return filing can be done completely online. We are here to help you not miss deadlines or get fined with high amount. Hire truly dedicated professionals who always put you on the safer side.

Know more about GST & Registration

About TDS Return Filing

TDS (Tax Deducted at Source) return filing is a fundamental financial procedure in India. It involves reporting the tax deductions made by payers at the source of various transactions. This reporting ensures that taxes are collected and remitted accurately to the government. TDS return filing is not only a legal obligation but also a mechanism that supports transparency, revenue generation, and effective taxation. It plays a crucial role in maintaining a fair and efficient tax system in the country. When it comes to efficient and accurate TDS return filing, Legal251 stands as a reliable partner. Our team consists of seasoned professionals well-versed in the nuances of India's taxation landscape, ensuring your TDS returns are filed correctly. By choosing Legal251, you're not just availing TDS return filing services; you're partnering with professionals who are dedicated to ensuring your financial success. Let us handle the complexities of TDS return filing, allowing you to concentrate on expanding your business horizons. Reach out to Legal251 today and experience the ease and professionalism of having a committed team manage your taxation requirements.

Please select Number of Parties / Deductites Quarterly :

Name:

Email:

Contact no:

Select Location:

Starter

₹2251/Yearly

₹2813.00 Save 25%

Requirements:-

Inclusions:-

basic

₹3251/Yearly

₹4063.75.00 Save 25%

Requirements:-

Inclusions:-

Starter

₹7251/Yearly

₹9063.00 Save 25%

Requirements:-

Inclusions:-

basic

₹12251/Yearly

₹15313.75.00 Save 25%

Requirements:-

Inclusions:-

Starter

₹24251/Yearly

₹30313.75.00 Save 25%

Requirements:-

Inclusions:-

Starter

₹36251/Yearly

₹45313.75.00 Save 25%

Requirements:-

Inclusions:-

ENTERPRISE SOLUTION

Form 24Q

This form is used to report TDS on salaries. It involves detailing the salaries paid, tax deductions made, and other relevant information. At Legal251, our adept team specialises in handling Form 24Q with accuracy, ensuring your TDS on salaries is managed seamlessly.

Legal Compliance

Financial Transparency

Government Revenue

Penalty Avoidance

Comprehensive Records

Smooth Business Operations

Compliance Confidence

Reduced Tax Liability

Seamlessness in Transactions

Professional Reputation

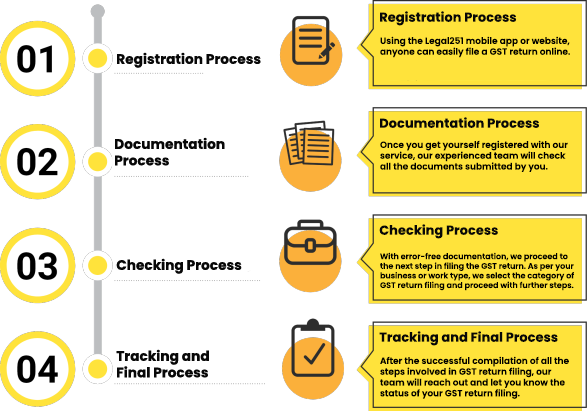

Our team will look into the documents that you have submitted, reviewing any false or mistaken information to keep you comfortable.

Our best experts are here to deal with document necessities & to fulfil your return filing needs.

On the basics of the details that you submitted our experts will take care of the entire process, from gathering comprehensive details about deductors and deducts to accurately reporting.

The respective experts will proceed further with your documents in order to file your TDS Return.

You are supposed to wait until our experts reach out to notify you of the status of your TDS return as filed.

FREQUENTLY ASKED QUESTIONS

THEY TRUST US

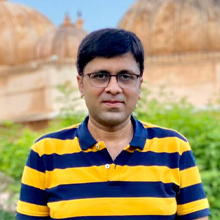

Mr. Rajat Maheshwari

Director Rajat Gems & Jewellery Pvt. Ltd.

Legal251 is the

best platform for getting consultancy be it in any legal domain they provide

best solution for your query.I am satisfied with their work. What i was expecting i

got it from Legal251. And I would really appreciate their cooperative work and how

they deal and cooperate with their customers.

They are the best in business as you may know. There are many complications in

Filing

GST & Income Tax returns for jewellery supply & design business they make all these

very easy and

efficient.

Mr. Chirag Jain

Director Samrudhi Innovation

For people like

us who are surrounded by work, legal251 is like a gift. Be it a busy day, or a

deadline, legal251 can always be counted upon. The customer service is always up to

the mark and the advices and solutions are always promising. Within 48 hrs of the

query you can have your solution in your hand, and all this, just a few clicks away

and inside your pocket. Legal work is now on a whole different level.

Mr. Sachin Karma

Co-Founder Today's Bharat

Legal251 changes

the very idea which most people have about getting any legal work done. Making the

whole process so convenient and also online makes it so easy for everyone to work

with. If talking about quality work, they have absolutely no match. A platform as

big as Today's Bharat required a very complete and descriptive terms of condition

and privacy policy. This was greatly achieved with the help of experts at

Legal251.

Mr. Vipin Soni

Well Known Financial Consultant

I'm thrilled to share my exceptional experience with LEGAL251. Their top priority is evident: providing the best and speediest solutions. Their professionalism and expertise stood out. The remarkable speed at which LEGAL251 operates truly sets them apart. Their responses were prompt, and packed with insightful guidance. Any queries I had were addressed immediately. For those seeking legal assistance that's efficient and of the highest quality, I wholeheartedly endorse LEGAL251.

Growth & Improvement

We believe in growth and improvement at all costs. For us, growth is the law of life and it shall be fulfilled. We know the importance of business and its growth for you.

Support & Availability

We feel how much pain even a small problem or query can cause, that is the reason we are available to support you and solve any of such problems at every particular instance in time.

Experienced Team

All the members of our team are experienced individuals who believe in professionalism and customer satisfaction above all. Each one of them is passionate in their respective fields.

Focus

Any assigned task is of utmost importance to us, that's why our team members are always focused on taking care of even the smallest of our clients' needs and requirements.

Value for Money

We understand that the money being spent is hard-earned, therefore we utilize every single penny that you pay us in the most effective way possible hence providing the best value for money.

Care & Regards

We believe you to be a part of this family and that all your problems, as well as achievements, are our very own. Your interests are ours and their fulfillment is at the top in our regards.

Hi we are Online!

We are here to help you! Chat with us on WhatsApp for any discount queries or more.